Research, insight, and education focusing on bitcoin, blockchain, digital assets, and network economics.

Bitcoin Macro Investor's Notebook

20 January 2026

This Bitcoin Macro Investor's Notebook is a professional-grade analytical framework for understanding Bitcoin as a macro asset, built for investors who think in discount rates, regimes, and cross-asset signals . It develops first-principles analyses grounded in credit cycles, dollar liquidity, present-value mechanics, and intermarket structure. Bitcoin is examined as a long-duration, high-convexity risk asset whose price behavior reflects prevailing macro conditions. The work decomposes Bitcoin’s historical cycles into measurable drivers and documents recurring regime patterns using empirical evidence.

The intended audience is sophisticated investors with quantitative literacy—portfolio managers, CIOs, analysts, and allocators familiar with bonds, currencies, volatility, and risk premia. The analysis draws on established academic research in asset pricing, macroeconomics, and market structure, while remaining analytical and educational in nature. Each framework is carried through to practical, testable decision rules that define when expected returns have historically shifted in a material way, presented to support independent evaluation and disciplined judgment.

Includes “A Tactical Bitcoin Allocation Framework” and

“Bitcoin ETF Flows as a Predictor of Momentum”

A Tactical Bitcoin Allocation Framework

7 January 2026 Premium Research Note

Bitcoin tends to deliver its strongest returns when it feels least urgent. This research identifies a persistent inverse relationship between trailing volatility and future performance, where calm markets have historically preceded strong gains and turbulent periods have followed returns already realized. Fully consistent with modern portfolio theory, the framework converts this observable condition into disciplined position sizing rather than price prediction, offering investors a repeatable, institutionally coherent method for increasing exposure when expected returns are higher.

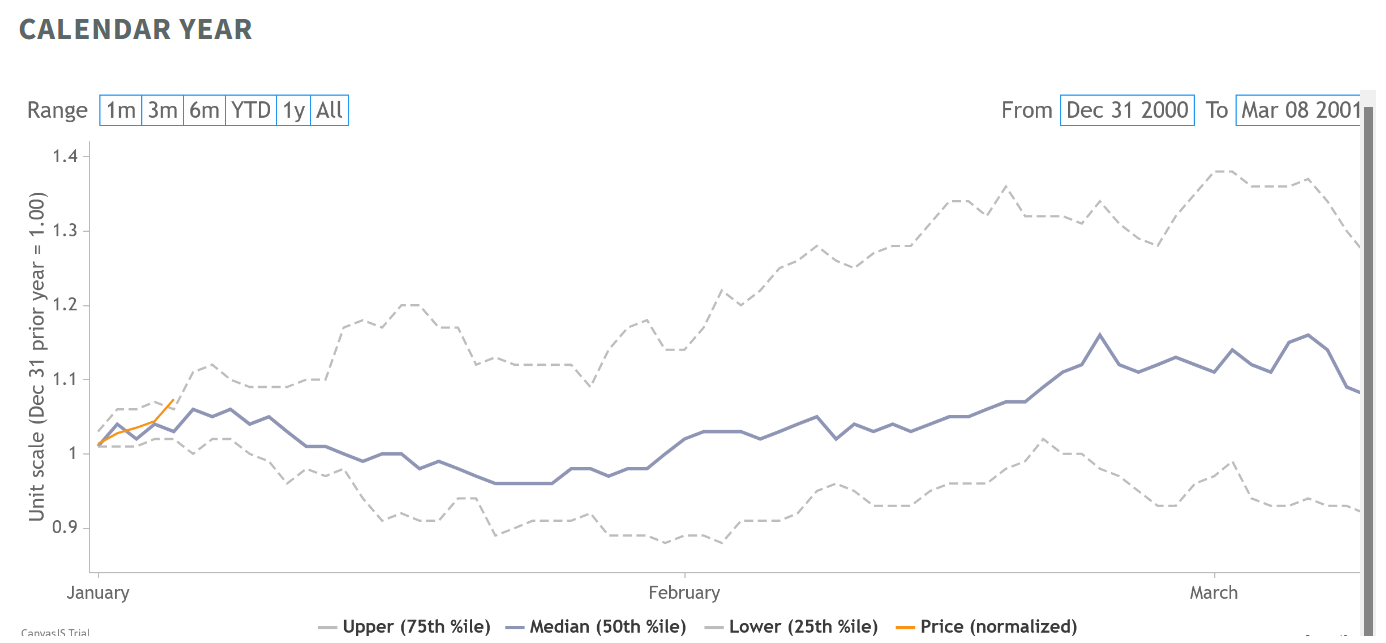

Bitcoin Seasonality Dashboard

January 2025

Seasonal trends for Bitcoin are based on ten years of historical daily data. This process isolates recurring calendar effects—such as tax timing, liquidity cycles, and behavioral patterns—that have appeared repeatedly across market regimes. The resulting seasonality profile describes historical tendencies and have repeated over time.

Benjamin Franklin: Bitcoin’s Founding Father

Bitcoin’s Founding Father connects Benjamin Franklin’s 1729 land-backed paper money system to Bitcoin’s economic model. Franklin argued that money must reflect productive labor, not government decree—a principle echoed in Bitcoin’s design. His self-liquidating, asset-backed currency offered monetary sovereignty to the colonies, challenging British control. When Parliament outlawed colonial currency, it ignited a crisis of independence. Just as Franklin’s system threatened imperial power, Bitcoin challenges modern governments’ monetary dominance—making the fight over money the Revolution’s true beginning.

4 August 2025

hot CIDR Podcast

One-Third of All Bitcoin Have Been Lost Forever

Over one-third of all bitcoin ever mined have been permanently removed from circulation. This research note updates prior estimates from April 2020, which identified just over 4 million lost coins. As of mid-2025, that figure exceeds 6 million, with projections indicating it will surpass 7 million by September. In just over five years, more than 2 million additional bitcoin have been irretrievably lost. While the annual loss rate has declined slightly, the total number of inaccessible coins continues to grow—underscoring the need to adjust supply-side assumptions in any credible valuation model.

From Barter to Bitcoin

A Ten Minute History of Money

From ancient trade to digital gold, this fast-paced video traces the evolution of money in just 10 minutes. Discover how rocks, metal coins, paper notes, and central banks led us to the rise of Bitcoin. Perfect for anyone curious about what money is, where money came from, and where it’s going.

10 April 2025

Cane Island Digital Research has been used in over 100 countries around the world.